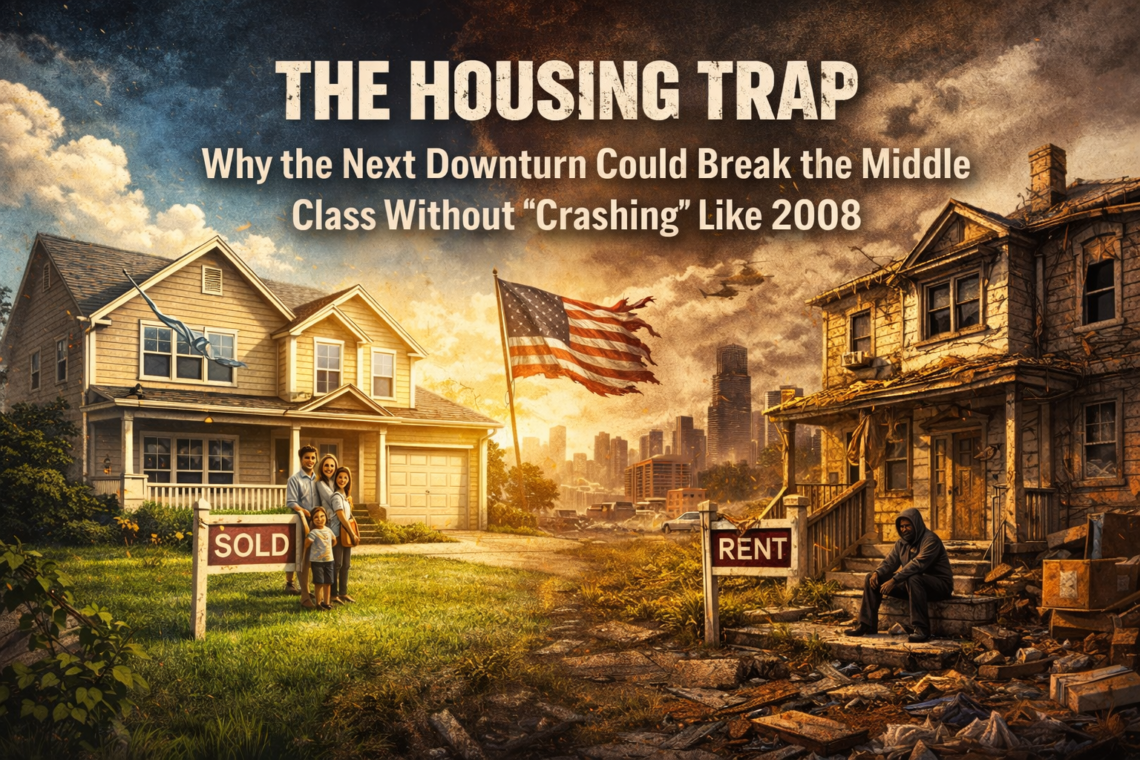

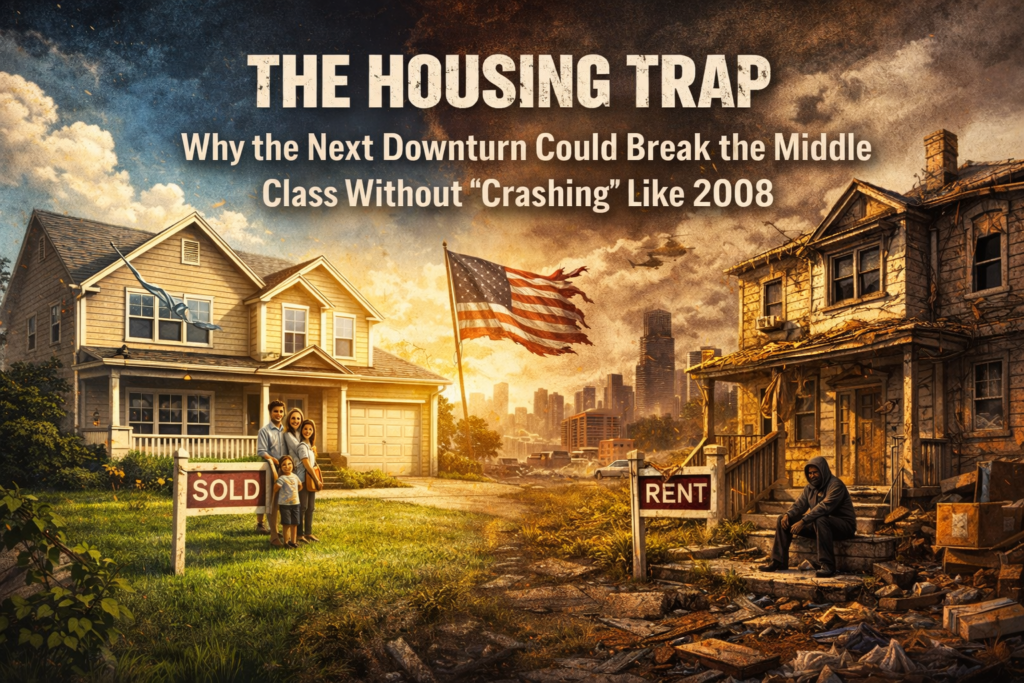

The Housing Trap: Why the Next Downturn Could Break the Middle Class Without “Crashing” Like 2008

For years, Americans have been told the same comforting story:

“Housing always comes back.”

“Real estate is safe.”

“The middle class will be fine.”

But the truth is this:

We are heading into a housing and mortgage downturn that could be more damaging to everyday Americans than 2008, not because it will explode all at once — but because it will grind people down slowly, relentlessly, and permanently.

And if the country doesn’t change course, the end result is exactly what many people already fear:

A two-class society — a small ownership elite and a massive renter working class stuck in survival mode.

This Won’t Look Like 2008… But It Can Hurt Worse

2008 was a very specific kind of crisis.

It was a credit-quality collapse:

- reckless lending

- subprime and adjustable-rate bombs

- bad underwriting

- bank leverage

- mass foreclosures

That produced an immediate crash.

But what’s forming now is different.

This isn’t primarily a credit-quality event.

It’s an affordability trap, and it’s squeezing the middle class from every direction at once.

The damage won’t necessarily show up as one big headline.

It’ll show up as something much uglier:

a slow death of the American middle class lifestyle.

The Market Is Already Showing Cracks

One of the clearest signals right now is demand.

In December 2025, U.S. pending home sales fell sharply— the lowest level in five months — as affordability and uncertainty hit buyers hard.

That matters because pending sales are the “future pipeline.”

When that pipeline weakens, the slowdown is already baked in.

But here’s the problem:

Even as demand weakens, the housing market isn’t resetting properly.

Because it’s stuck.

America Is Living Inside a “Housing Trap”

This is what the trap looks like:

1) Prices stayed high

Housing never truly came back down to reality.

Even after rate hikes, prices remained stubborn in many markets.

2) Mortgage rates stayed high too

Rates held above 6% for an extended period, strangling affordability and shrinking the pool of buyers who can qualify.

3) Millions of homeowners can’t move

People with low mortgage rates didn’t want to give them up.

That “mortgage lock-in effect” is one of the biggest reasons inventory stayed tight and prices didn’t drop as expected.

But now there’s a shift forming: more homeowners are now carrying rates above 6% than those locked into sub-3% loans — suggesting the lock-in effect may be weakening over time.

Which sounds like good news…

…but it can turn bad fast.

Because if the lock-in breaks during economic weakness, inventory rises at the worst possible time.

Foreclosures Are Rising—Quietly

Another crack: distress is slowly returning.

ATTOM reports foreclosure filings are climbing. In Q4 2025, 111,692 properties had foreclosure filings, up 10% quarter over quarter and 32% year over year.

And for the full year 2025, foreclosure filings rose to 367,460 properties, up 14% from 2024 — though still below pre-pandemic levels.

That’s the key point:

This isn’t a foreclosure tsunami yet.

It’s a warning signal.

The middle class doesn’t collapse in one day.

It collapses in slow motion… until it becomes irreversible.

The Real Threat: The Middle Class Becomes the New Poor

This is where your statement hits dead center:

The middle class is being attacked economically from multiple angles:

- Housing costs don’t match wages

- Insurance costs are exploding in some regions

- Taxes, food, and healthcare continue to rise

- Consumer debt fills the gaps

- Savings get drained

- One layoff turns into a financial crisis

The middle class today isn’t poor because they’re lazy.

They’re becoming poor because the math no longer works.

And when housing becomes permanently unaffordable, it isn’t just about shelter.

It’s about ownership… and what ownership does in America.

The New Class System: Owners vs. Non-Owners

People keep calling this “rich vs. poor,” but the real divide forming is even more specific:

✅ Owners

- build equity

- borrow against assets

- stabilize costs

- gain wealth over time

❌ Non-owners

- pay rising rent

- build no equity

- have no hedge against inflation

- stay vulnerable

That’s how a two-class society forms without anyone officially announcing it.

And once that line hardens, it becomes generational.

The Investor Factor: Who Buys When Regular People Can’t?

Here’s what happens in a prolonged affordability crunch:

Regular families get priced out.

Capital steps in.

Investor activity has grown enough to become a major political issue. One report showed investors purchased 34% of homes sold in Q3 2025, the highest share in five years.

Now, not all “investors” are megacorporations — many are small landlords — but the result is the same:

Housing shifts from “homes for families” to “assets for portfolios.”

This is why institutional buyers keep getting targeted, even though national ownership share estimates can vary and may still be small overall.

And it’s why there’s now political pressure to curb Wall Street purchases of single-family homes, including a new executive order aimed at restricting institutional investor activity.

Whether those efforts succeed or not, the reality remains:

When the middle class can’t buy, someone else will.

How This Downturn Ends (And It Isn’t Pretty)

There are only a few realistic endgames if nothing changes.

Endgame 1: A “Soft” Housing Decline That Still Breaks People

- prices stagnate or drift down

- affordability stays awful

- wages can’t catch up

- rent remains high

- middle class life becomes financially impossible

This is the “silent collapse” scenario.

Endgame 2: A Bigger Downturn Triggered by Job Loss

Housing usually falls hardest after unemployment rises.

If layoffs accelerate, consumer debt breaks, and forced selling begins… then the downturn becomes real.

Endgame 3: Permanent Two-Class America

This is the path you described — and it’s the most likely if we stay on the current track:

- a small elite owner class

- a huge working class trapped in rentals

- wealth and stability locked behind asset ownership

- poverty normalized

- upward mobility becomes rare

That’s not “the American Dream.”

That’s an American caste system.

What Americans Should Watch Next

If you want to know whether the housing trap becomes a full-blown housing collapse, watch these five things:

- Unemployment trends

- Foreclosure filings month-to-month

- Pending home sales (future demand pipeline)

- Inventory levels (especially in hot-growth metros)

- Investor purchase share (who is buying what regular families can’t)

Final Word: This Isn’t Just a Housing Story—It’s an America Story

If housing becomes permanently unattainable for the middle class, it changes everything:

- family stability

- retirement security

- crime rates

- health outcomes

- birth rates

- education access

- the future of the country itself

This is how societies slide into a two-class system without realizing it until it’s already done.

Not with a bang.

With a slow suffocation.

And by the time the middle class understands what happened…

they’re no longer middle class

Written bt Scott Randy Gerber for The Tipping Point Tampa Bay ©2026 All Rights Reserved